Evening everyone!

I just wanted to give a quick market update because well, today was brutal. The legacy markets had an absolutely brutal day, especially the Nasdaq. Nasdaq down 5%, 647 pts. The Dow down 1000 pts today, 3.12%. S&P 500 down 3.5%. Russell 2000 down 4%.

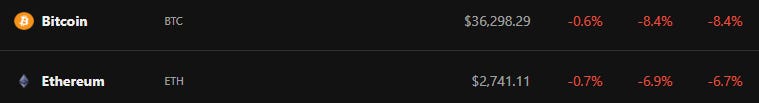

Bitcoin and the crypto markets took a serious hit too. They had a big ol’ rally yesterday and then today they fell off a cliff. Yesterday Bitcoin rallied from $37,500 ish, right up to $40,000 and then this morning it dropped from $39,500 or so to just over $36,000 and in the matter of a couple of hours.

There was ah about $186,000,000 of liquidations in Bitcoin and $63,000,000 of Ethereum. That contributed pretty heavily to the massive downswing. And although today is just one of those red days that give you all those feelings, I want to remind you that some of the long-term metrics are still looking absolutely wonderful. Now are the legacy markets and the crypto market going to continue in a down trend for a while. Maybe. Probably; but in the medium to long-term, the cryptocurrency markets are really really poised to do very well.

Just to quickly cover a couple of the metrics that I watch; the Pi cycle top indicator, which is what I use to let us know (as one of the indicators) when we're close to a market top, that trend is continuing to widen. Which means, the wider it is the further away we are from the top. It's been widening since the beginning of the year.

The reserve risk indicator is nearly at an all time low, not quite but it is well in the oversold category.

The coins on exchange position continues to trend downwards rapidly. As I mentioned in a recent article, that trend is accelerating downwards which means more and more coins are leaving exchanges faster as less and less coins are available on exchanges. Regardless of today's price action, there will be a liquidity crunch at some point. We’re just running out of bitcoin to be honest with you now.

Now, it is worth noting that many institutions are buying their bitcoin OTC and not from these exchange wallets. But we also have metrics that show bitcoin miners are generally hoarding their bitcoin rather than constantly selling the way they were doing a couple of years ago, which indicates to me that miners are bullish. Institutions are bullish. And the reserves on exchanges are drying up. So, once retail has a reason to come back into the game (which has been surprisingly low for the last year or 2) then I don't see much choice (but) to see that create significant price action.

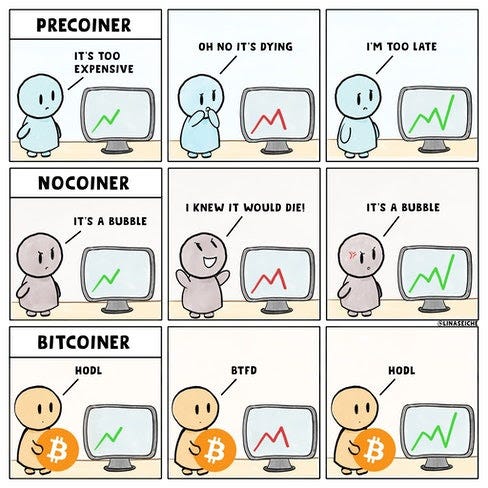

So as far as what's coming, (my personal plan) I still continue to dollar cost average into bitcoin regularly. I'm not looking to add to my altcoin positions here. There's a lot of uncertainty in the market going forward the next couple of months. The legacy markets are connected to the cryptocurrency markets because of the institutional adoption that we've seen. I will be continuing to stack Sats and hopefully putting some dollars off to the side. So that way if we do have a continued down market then we'll be able to do some aggressive dip buying. Again, none of this is financial advice. This is just what I'm doing, what I'm thinking, what I'm seeing.

I don't expect to see a significant string of days like today in either market, especially considering that the Fed said that 50 basis point hike was on the table for the next couple of meetings but they were not considering a 75 basis point hike. Now in reality the difference between 50 and 75 is relatively insignificant when it comes to the big picture, but that should help ease the anxiety of the markets that exists right now.

One bright spot of news is apparently Joe Rogan said that Bitcoin is now a viable currency. Now, I don't take what Joe Rogan says to be any kind of economic expert by any means. However, he does have something like 11 Million subscribers on Spotify and a ton of YouTube followers. There's a bunch of data out there that indicates he has a larger following than any of the mainstream media platforms (you know, CNN, Fox News, MSNBC; all those). So, when he starts talking about something a lot of people hear it. Now I don't think that him mentioning it in this context is going to be enough to create that retail enthusiasm and that FOMO, especially after the brutal market conditions we've had over the last couple months; but every seed planted helps to grow the mainstream adoption and to get people involved and that's really what we need to ever see significant upward price action trends again.

So yeah, that's it for today just a quick little message out there. If you're concerned about what's happening just Zoom out, look at the trends from 2, 3, 4, 5 years back. It'll help you feel better.

And more importantly, try to get some research in to understand the fundamentals of what Bitcoin is, what Bitcoin does, why it's going to make a difference in the world in the long run.

In the meantime, (if it fits your portfolio strategy) keep stacking. It's on sale right now.

Okay, cheers y'all. Have a great day.

Share this post