Hey there, Friends!

We're back at it again, cracking the code on all this financial stuff. Remember, we're in this together, breaking down the fancy jargon and making this whole money thing make sense. Swing by my Social Media - I keep the conversation going there with more insights and real-time updates.

That being said, today we're going to talk about Part 3 of a Series Exploring the Dollar’s Global Paradox...

The Triffin Trap

Donald Trump, the self-proclaimed “tariff man,” is back in the White House as I am sure you have noticed. Presently, in April 2025, he’s rolling the dice on a global economic poker game. His new playbook of sky-high tariffs, government downsizing, and whispers of eliminating the federal income tax—aims to reshape America’s role in a world still gripped by the Triffin Paradox.

If you missed parts 1 and 2 (links), here’s the TLDR: for the U.S. dollar to function as the world’s reserve currency, America must continuously export dollars through trade deficits. This sustains global liquidity—but at the cost of growing U.S. debt, inflation risk, and internal economic strain. Eventually that all leads to a lack of confidence in the dollar system and the whole thing comes crumbling down. It’s a balancing act that pits global stability against national well-being. Trump’s latest policies look like a bold attempt to break this cycle—or a reckless lunge that could send the dollar tumbling from its tightrope.

Let’s unpack his actions—from Beijing’s counterpunches to Elon Musk’s efficiency crusade—and ask the big question: is this a masterstroke... or a misstep?

Trump’s Four-Pronged Policy Playbook

Trump’s agenda feels like a full-court press on the post-Bretton Woods order. Here’s what’s on the table:

1. International Tariffs (Weaponized Trade):

Trump has unleashed a tariff tsunami, most dramatically against China. By April 9, 2025, tariffs on Chinese imports were hiked to 125% (145% with legacy levies) up from 34% just days earlier, citing “lack of respect” for global markets. China retaliated swiftly with matching tariffs. Other nations face a 10% baseline, while Mexico and Canada were hit with 25% tariffs tied to border and fentanyl issues.

2. Government Downsizing:

Trump’s aggressive push to shrink the federal footprint includes slashing agencies like USAID, Voice of America, and environmental programs, aiming for a “lean, mean, America-first machine.”

3. Elon Musk’s DOGE Initiatives:

Musk, tapped to head the new Department of Government Efficiency (DOGE), has promised to “X-ify” the bureaucracy. He promises to digitize it, strip it down, and disrupt it like a bloated startup. Think: federal government meets Silicon Valley.

4. Elimination of the Federal Income Tax:

Trump has floated replacing income tax entirely with higher tariffs or consumption-based taxes. Bold move considering federal revenue streams. But let’s face it, the money printer never runs out of ink.

These aren’t just policy pivots. They are direct confrontations with the mechanics of the Triffin Paradox. Trump is tightening the global dollar spigot, starving the very system that relies on dollar liquidity. But to what end?

Short-Term Effects

The immediate fallout is loud, fast, and full of friction:

Tariff Turbulence

The U.S.-China trade war, now at 145% vs. 125% tariffs, is throttling trade. Imports from China—worth $450 billion annually—are expected to drop by over $800 billion in 2025. Price spikes are already hitting U.S. consumers. Amazon’s Andy Jassy warned sellers are passing on costs, with some hoarding inventory to get ahead of the chaos. Asian allies like Vietnam and South Korea, caught in the crossfire, are seeing disrupted chip and auto supply chains. Industrial metals are spiking due to steel and aluminum tariffs.

Effects of Tariffs on Different Income GroupsLowest 10% - $1,700 additional in estimated annual tariff cost - 3%-5% of Income

Middle 50% - $1,900 in estimated annual tariff cost - Although this varies significantly based on lifestyle choices. 1%-3% of Income

Top 10% - $4,600 in additional estimated annual tariff cost - <1% of Income

Tariffs function as a regressive tax, disproportionately affecting lower-income households. These figures illustrate that while higher-income households may face higher absolute costs, the relative burden is heavier on lower-income groups.

Government Cuts

Slashing agencies could mean immediate job losses and losses of soft-power influence abroad. This hasn’t made a significant impact in unemployment numbers yet, but it might soon. Markets are already jittery; stocks plunged 17% in early April (the worst start under any president since 1957), before a modest rebound after Trump paused non-China tariffs for 90 days. The silver lining is a deflationary aspect that could slightly offset the inflationary aspect of tariffs.DOGE Whiplash

Musk’s tech-powered efficiency drive could yield long-term cost savings, but short-term chaos is mounting. Unvetted cuts are creating service gaps and triggering bureaucratic confusion, not to mention public outcries. We need to “take our medicine”, I agree. But we don’t inject bleach as medicine to deal with Covid either. Anyway, reducing waste and increasing efficiency is also deflationary if it can stick.Elimination of Income Tax

Eliminating income tax for individuals earning under $150,000 could provide relief to lower and middle-income households. Enough to offset tariffs? Let’s look.

For Lower-Income Households: The savings from income tax elimination may negligible since they contribute only 2.3% of the tax.

For Middle-Income Households: They might experience a significant tax benefit. The closer you are to $150k the better this will feel for your bank account. This group still spends most of their income, so this part of the tax plan should directly translate into economic stimulus.

For Higher-Income Households: They may modestly benefit from income tax elimination and are better positioned to absorb the increased costs from tariffs. However, I doubt this will change their spending habits in any meaningful way.

The Truth

So, as you can see, Americans making <$50k per year get the worst deal, likely having tariff exacerbated expenses significantly outpacing any tax relief. It boils down to $50 or $100 a month, which may not seem like a big deal to you, but I promise that to many Americans, $50/month is a significant problem.

Low-income workers are the clear losers here.

Middle-income households benefit the most by far.

High earners benefit modestly in real dollars, but not in lifestyle-changing ways.

Ultra-wealthy get a small win, but it’s statistically irrelevant for them.

Look, there’s no sugarcoating it—this setup is punishing on lower-income Americans (a huge percentage of Trumps voter base). The elimination of income tax does very little for them, and tariffs act like a stealth tax on everyday necessities. For a household living paycheck to paycheck, an extra $50–$100 per month in expenses can be the difference between stability and spiraling. It’s regressive, plain and simple.

Is There an Upside?

It does not make up for the above, but there’s a silver lining—and it’s not small. This policy shift, whether intentional or not, massively benefits the middle class—especially earners in that $75K–$150K range. According to the census bureau, 27.8% of households earned between $75,000 and $149,999 in 2022. This is the group that:

Has the potential to save and invest

Buys homes, starts businesses, and builds wealth

Sends kids to college and reinvests in their communities

Drives most of the real economic productivity in America

If this tax shift truly strengthens the middle class, it could revitalize the core of the American Dream. A strong middle class means:

More economic resilience

Less political instability

Higher domestic demand and production

A broader base of financial independence

In short, this is the class that makes America hum. If this tax policy manages to boost their buying power and optimism—even while screwing up in other ways—it’s worth acknowledging. It’s also worth remembering that no such tax plan has come to fruition. To date, this tax plan is entirely lip service.

But here’s the real human part: we don’t need to crush the poor to help the middle. Good policy shouldn’t pit one against the other. Life is about more than GDP. So, if you’re feeling mixed about all this, you should. Humans are meant to feel something. That’s the paradox we’re trapped in. Welcome to Triffin’s world.

A New Order or a Broken One?

Looking ahead at long term effects, Trump’s gamble might rewrite the rules—or set fire to the playbook. Only time will tell, and Trump really doesn’t have that much time to let this play out. Midterms will be the primary focus in congress in only a year, and after that DC may be completely gridlocked. Let’s imagine that we have enough runway to see this play out before democrats get a chance to stall or undo the current momentum.

Tariff-Driven Reshoring

High tariffs could finally re-onshore U.S. manufacturing, especially in sectors like steel and semiconductors. One White House official claimed allies are aligning defense and trade policies to counter China. But a prolonged trade war may backfire if Beijing digs in, betting on its tighter control over domestic demand. Let’s keep in mind that building the manufacturing infrastructure can take years. Will policy change by then? Will people want to make significant investment to build such things with the uncertainty that comes next political cycle?Leaner Government, Riskier Future

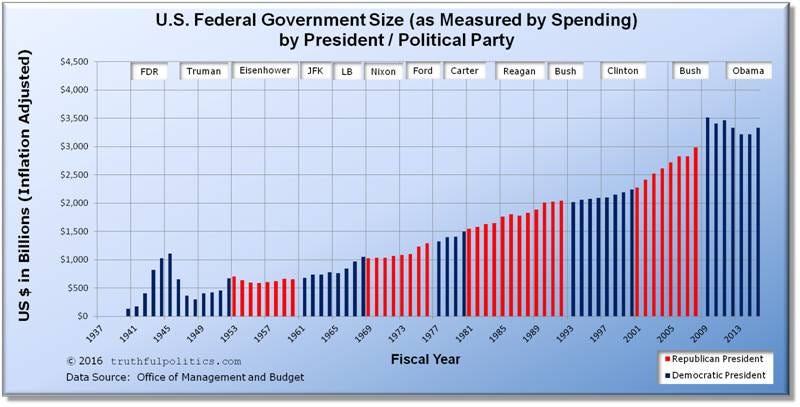

Trimming bureaucracy may cut waste... or hollow out essential services like public health, disaster preparedness, and environmental oversight. Maybe both can be true at the same time. Truman, in the wake of FDR’s war machine, was the last president to actually shrink the government in real, sustained terms. Since then, the Federal government hasn’t reduced its size or power in any significant way and can’t pass their own audits to save their lives.Reducing the federal footprint? I’m in—within reason. But let’s be real: that movement won’t gain real traction until real Bitcoiners hold actual political power. Best guess; Maybe in a decade.

The DOGE Legacy:

Musk’s “government as code” vision could improve transparency—but overzealous deregulation may trigger lawsuits, privacy issues, or environmental negligence. I’m a huge fan of the “rules, not rulers” ethos, but let’s face it, no group of politically powerful will offer away that power. If Elon manages to replicate even a fraction of what Truman pulled off, it would be the first real rollback of federal sprawl in nearly 80 years. But let’s not pretend that firing a few bureaucrats compares to demobilizing 10 million troops.Fiscal Mayhem:

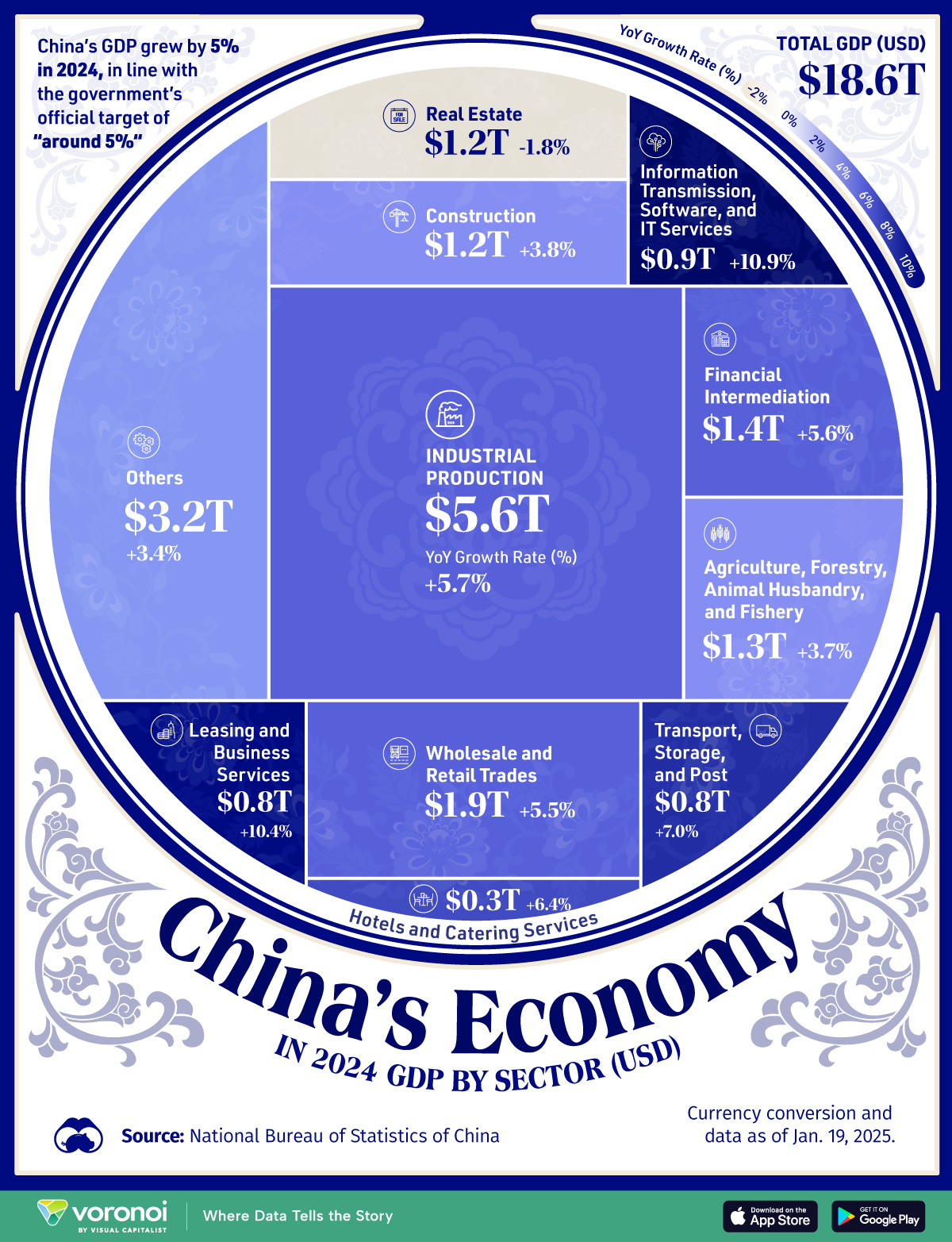

Tariffs alone won’t plug the revenue hole. We are $36 trillion in debt with almost $2 trillion in deficit this year alone. The math doesn’t lie; even if tariffs generate $1.2 trillion over a decade, it’s a rounding error in today’s debt landscape. China’s counter-tariffs shrink our export markets, and inflation from protectionism could devalue the dollar, leading to rising yields and fading global trust, but also a more competitive American export economy and potentially cheaper debt obligations.

Don’t get me wrong, Change NEEDS to happen. I’m not saying I know what the right answers are here, I’m simply trying to articulate what is happening and what the consequences are likely to be. From there we can make our own decisions as we each see fit.

Strategic Twist

What if this chaos is the point? That narrative sure is making the rounds lately. Let’s give the idea a moment of thought.

There’s a case to be made that Trump is deliberately forcing the issue—inducing inflation, sparking panic, and pressuring the Federal Reserve to cut rates and devalue the dollar. A weaker dollar would:

Boost U.S. exports

Narrow trade deficits

Make U.S. debt more manageable (as foreign-held dollar assets lose value)

China seems to be the specific target here, isolated with brutal tariffs while Trump temporarily pauses tariffs elsewhere at 10%. Is it a surgical economic strike meant to rebalance trade and force de-dollarization pain on U.S. rivals before they can build alternatives? Maybe. Countries are now faced with a decision. They are being forced to pick a side more so now than any time since the USSR was around.

But former trade official Nazak Nikakhtar warns Trump may be bluffing with a weak hand. The Chinese economy may be impacted by these tariffs more negatively than our own, sure. But also, China isn’t ruled by voter sentiment or fragile markets—they can absorb far more short-term pain. “Americans,” Nazak said, “can’t withstand a single day of economic discomfort.” I think the last couple weeks have proven her point.

Meanwhile, the bond market called Trump’s bluff. Today we sit at 4.33%, but only a couple days ago yields surged to 4.77%, a clear sign that investor confidence has limits. Was this spike because China and Japan are both selling off US treasuries? Probably. Will that behavior continue? Probably. Point is that there is more supply than demand and therefore yield has to go up. Thats the opposite of what the Whitehouse is trying to accomplish. Confidence in the Fed having control of the market is starting to come into question. And confidence is the only thing backing the dollar these days (or any fiat for that matter).

A Crack in the System

Let’s not forget in 2008, the last time this system buckled under its own contradictions, a mysterious white paper appeared. It offered an exit—a decentralized system immune to fiat manipulation and Triffin-style traps.

We’ll explore it more in Part 5, but keep this in mind:

As governments leverage debt and weaponize volatility, Bitcoin offers individuals asymmetric leverage—a bet on mathematical scarcity, neutrality, and long-term sovereignty.

In other words, Bitcoin is what you buy when you stop trusting the politicians around you. And who trusts that group in 2025?

What’s Next?

Trump’s high-stakes gamble is rewriting the playbook. Will it stabilize the system or accelerate its unraveling? Do we want the power of exporting our inflation to the world, or do we pivot here before the paradox endgame rings true?

Policymakers must carefully consider these dynamics to ensure that tax and tariff reforms do not inadvertently exacerbate economic disparities. Do you trust them to do that? Do you expect Washington to fix the problems coming for you? I don’t, and I hope that you take this information into consideration such that you can go do something about it. You cannot fix the economy. You cannot fix politics. Ukraine, Gaza, Covid? No, No and No. All you can do is try to protect yourself, your family and your community. Be part of the solution by helping yourself and those you are intertwined with.

Don’t just read. Respond.

If you found value in this, share it. Talk about it. Protect your circle. The next phase isn’t about complaining—it’s about preparing. Pick someone you are trying to help and then do it. Start today.

In Part 4, we’ll explore:

The social and geopolitical fallout

How other nations are reacting

And how investors can protect themselves in a world where the reserve currency status is both a blessing and a ticking time bomb

For now, buckle up. The trade war isn’t cooling down—it’s just getting warmed up. I brought marshmallows just in case it gets hot.

Well, that's a wrap for today y’all. If you found this helpful or it got you thinking, why not hit that 'like' button and share it with your buddies? The more we share, the more we all learn.

Disclaimer: The goal here is to educate and entertain. However, keep in mind, this isn't financial advice. I'm a regular person like you, sharing my perspectives based on my personal research and experiences. Always do your own research (DYOR) and make your own informed decisions.

Your thoughts and feedback on the content are always welcome. Feel like chatting about something? Reach out here or on Social Media, and let's start a conversation.

If you're viewing this in podcast notes, some embedded links might not be accessible. For the full experience and all the juicy links, head over to my Substack (lumberhawknews.substack.com).

Cheers!

If you would like to donate to support the Value for Value Bitcoin economy, below is my lightning wallet.

I love the content. Thanks for the obvious work you have put into the economic aspect of all this.