Welcome back to the Lumber Hawk Podcast y'all!

Happy Mother's Day to all the mothers out there. Especially my love, Ms. Nanner and my Mother. I love you both and I am grateful for you guys being in my life; past and present. For the rest of you out there listening, go be nice to the mothers in your lives. I'm sure they deserve it.

On to the rest of the podcast.

So, the markets are a bit of a mess. We had that brutal sell off in basically every market a couple days ago. If you feel a bit overwhelmed by all that, it's absolutely okay to go focus on something else in life. You can put your portfolio down and just ignore it. It's fine. But go find something that makes you happy. Spend some time with your family, go work on a hobby, read a book. It's okay, you don't have to watch the markets every day. But if that's what you're here for, (to hear about the markets) then let's get into it.

As usual, this is not financial advice. Again, I’m just a guy with a microphone telling you how I feel about life. Do your own research. Make your own choices.

Just going to go over some stuff pretty quickly.

The jobs report came back. We added 428,000 jobs in April, so that's nice and the 10 year treasury yield just hit a high of 3.13%. The 10 year treasury impacts a lot of market activity as I'm sure you are aware so, it's just good to keep an eye on that number.

If you haven't already heard, Fidelity has implemented a plan to allow investors to put bitcoin into their 401K. Fidelity is the largest 401K provider out there. It is expected that they are going to have a limit of not more than 20% of each customer's assets into Bitcoin. Also the program is optional, not only for the individual investors but also for each company being part of the program. Personally, I wouldn't want my employer to make that choice for me. So, if you have a Fidelity plan and you would like access to Bitcoin in your 401K then I would talk to your employer and make sure that they are not going to be opting out of that program on your behalf.

In a somewhat related note BlackRock (which is the world's largest asset manager with $10T in assets) created a blockchain ETF comprised of 34 (I misspoke saying 43) products, referring to blockchain and crypto as a “Megatrend”.

The head of BlackRock’s US I-Shares product, Rachel Aguirre, said:

“The expansion of our megatrends line-up today reflects the power of the millennial and rise of the self-directed investor, whose buying habits have reshaped mainstream consumer behaviors, and in turn, the companies in which they invest”

The 3 largest allocations of this fund are Coinbase, Marathon Digital and Riot Blockchain. Just to be clear, This ETF does not hold cryptocurrencies directly. It is an ETF of companies with cryptocurrency exposure, Coinbase being the prime example.

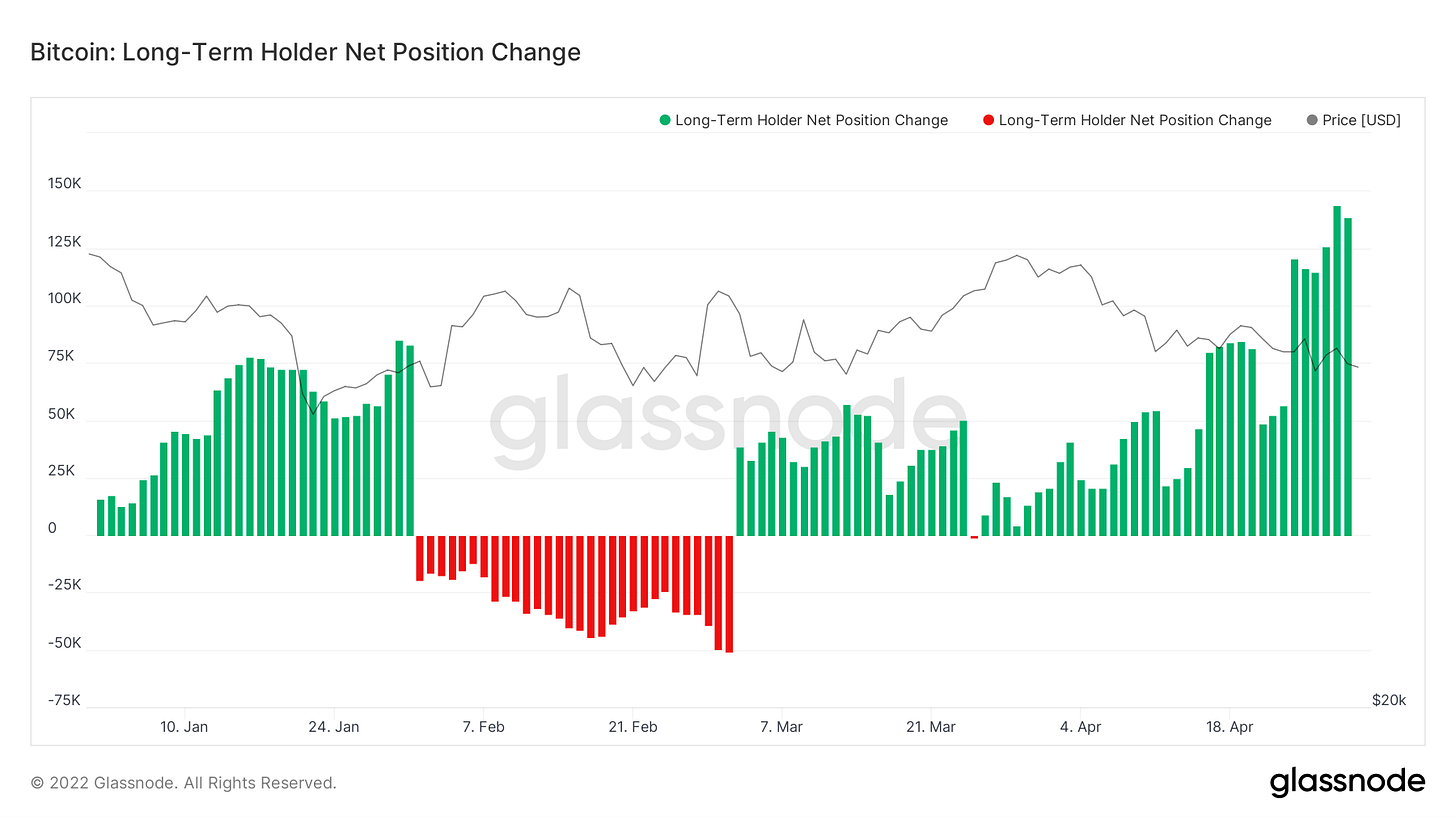

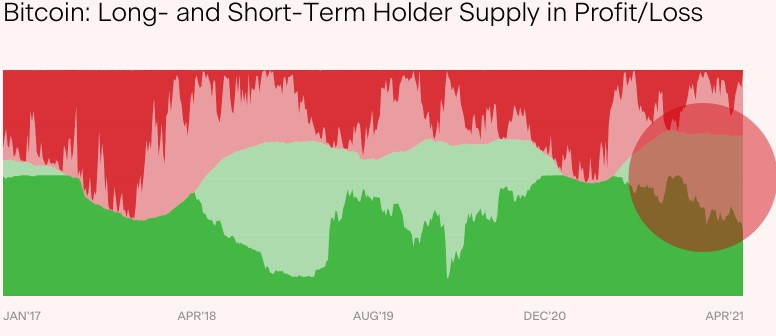

Next up I just wanted to quickly touch on the trends between long-term and short-term holders in Bitcoin. Just to oversimplify on why it's important, generally during bear markets long-term holders are accumulating, whereas short-term holders are selling off.

Short-term holders usually being newer investors (retail investors) who have a tendency to trade more emotionally. The long-term holders being the opposite. Whereas in a bull market you will see long-term holders selling off into short-term retail hands. As the price goes up, the short-term retail investor generally gets caught up in that FOMO cycle and the long-term investor is usually skimming profits as they are realizing significant gains.

The current trend has short-term holders selling to long-term holders, which is another confirmation of being in a bear market. Long-term holders now account for 82.86% of Bitcoin's circulating supply. That is the highest that number has been in several years. You can see how that goes hand in hand with the amount of bitcoin supply on exchanges that I talk about all the time, so I won't get back into that.

One of the things that this information tells me is that the illiquid supply crunch probably isn't going to change anytime soon. Generally these long-term bag holders are in it for the long run. You're not going to see these coins hit exchanges until we get significant price appreciation. I'm not saying that the market won't continue to go down (it might), but there's only so many coins out there left available to be sold. Nearly 83% of the coins are fairly well locked up and there's about two million coins left in circulating supply that's actually available to be purchased. Again, with the greater economy being the way it is, we absolutely could keep going down from here. There are plenty of people who think that we are going to retest $34,000 and maybe even $30,000. I don't really know if that's the case, but to be completely honest I didn't think we'd get as low as we are right now (yet, here we are).

But I do know that the lower we go the more long-term holder purchasing is going to take place. The institutions and the whales and the individuals who believe in what Bitcoin can do for this world are consuming as much of this product as they can.

There's only ever going to be 21 million coins and right now there's about 19 million coins and somewhere between 3 and 4 million coins are probably lost forever. There's about two million coins (maybe a little bit less than that) available on exchanges right now and that number is decreasing pretty rapidly. At some point we're just going to run out.

So when is the market going to reverse? Well, when the amount of Bitcoin available becomes so scarce, then it will take a very small catalyst in order to get an upwards price trend. That being said I still think that the bitcoin and larger crypto market is tied to the larger stock market situation and I don't see the stock market pivoting until the Fed pivots. Just a few days ago, the Fed announced the 50 basis point hike. They further clarified that 50 basis points is on the table for the next couple of meetings. 75 basis points is not on the table. We did see a short term rally based on that information and then a day later was that pretty significant crash that we saw. I mean, I don't know if I even want to call it a crash. It was 5% in the stock markets and 10 to 15% in the crypto markets. It's a correction though, for sure.

Anyways, the Fed doesn't really have any reason to pivot dovish until CPI data comes down. So, we [have] to keep an eye on those numbers. When the Fed sees a significant course adjustment in CPI data, they're probably going to have a lot of political pressure to stop raising interest rates. Maybe even cut rates. Maybe pause on tightening of their balance sheet. Especially considering that we are rolling into a midterm cycle, the political influences are not going to want to roll into an election cycle with recessionary conditions, increasing interest rates, high inflation, and no finish line in sight. So I would expect some time before then (even if it's just an empty demonstration) I wouldn't be surprised to see the Fed actually do a 25 basis point cut.

Now, not in this next meeting. They might do another 50 basis points (increase) 1 or 2 times and then maybe come late fall/early winter I could see them doing a 25 basis point cut, just to say oh “We won” regardless if that's true or not. But it will send a message to the markets and to the voters that they have inflation under control, they have the economy under control. Now, I'm not saying that that's actually going to be the case (everything under control), but that's the message that they're going to try to deliver. And if they do and it's somewhat believable, you could see a market pivot at that point. As far as what happens after that, it's too far out to tell so I'm not even going to speculate.

As far as when CPI data comes out

April data comes out on May 11th

May data comes out on June 10th

June data comes out on July 13th

July data comes out on August 10th

So those are dates to keep an eye on. We can use that information to try to guess what the Fed is going to do, just like the rest of the markets will. And you will see the markets respond accordingly.

The last thing I wanted to cover really doesn't have anything to do with the markets directly but it could have secondary effects and I don't really see a lot of people talking about it. Beijing has ordered a test, they're calling it a “stress test” to study what would happen to their economy if their economy was placed under a similar situation as to what Russia is right now with all of the western sanctions. It appears that they underestimated the response that the West would apply to Russia based on the invasion. They want to see what would happen to themselves if a situation like that were applied to them. It's pretty easy to point to Taiwan for the reason of this. An invasion of Taiwan is probably the only reason that these kinds of sanctions would ever be brought down on China. The impact of these kinds of sanctions on China would have a more significant impact on the rest of the planet than what Russia does. The sanctions on Russia have obviously had an impact on the global economy. On the flip side of that coin, the sanctions applied to China would have a much more devastating impact to China than these sanctions have to Russia. Not to imply they're not having a significant impact in Russia, they absolutely are. But just the way China is designed as the world's largest exporter, the number of people they have, their inability to grow enough food for their own people... All of these things.

All in all, I'm not too worried about it. I think that they're just doing the math on all potential situations. You know they've had their eyes on Taiwan for a very long time and I don't see that changing anytime soon, but I also don't see a military situation developing anytime soon with that.

That's all I have for today. Thank you for your support. These podcasts are available on Substack, Apple podcasts and Spotify. Feel free to check them out! Like, subscribe, all that stuff. As always feel free to hit me up either here in the comments or on Twitter @LumberHawk.

Cheers y'all. Have a great day!

Share this post