Hey there, Friends!

We're back at it again, cracking the code on all this financial stuff. Remember, we're in this together, breaking down the fancy jargon and making this whole money thing make sense. Swing by my Social Media - I keep the conversation going there with more insights and real-time updates.

That being said, today we're going to talk about a single graphic released by Bank of America...

“If you want to understand the future, look at what the incumbents quietly start admitting.”

— Someone paying attention

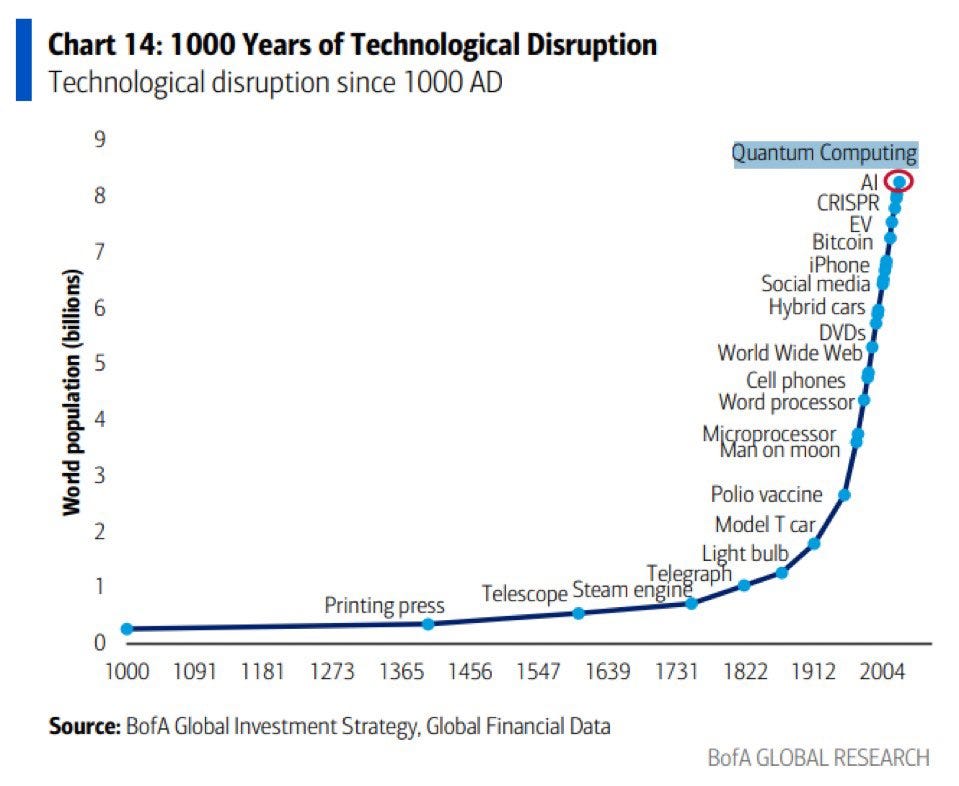

In a chart that should’ve broken headlines but barely rippled the surface of mainstream financial media, Bank of America did something subtle—but seismic.

They published a visualization called “1000 Years of Technological Disruption.” It plots 21 of the most world-altering innovations since the year 1000—things like the printing press, the steam engine, the lightbulb, the Model T, microprocessors, the internet, AI, and… yes…

Bitcoin.

Not blockchain.

Not “crypto.”

Bitcoin.

Let that settle in for a moment. According to one of the oldest and largest banks in the world, Bitcoin is among the 21 most disruptive breakthroughs in the last millennium—not in finance, but in human civilization.

The Curve of Disruption

The chart plots global population alongside innovation, showing a near-flat line for centuries—until the Industrial Revolution kicks off a sharp upward curve. Each new breakthrough accelerates the next. Steam becomes electricity. Electricity becomes code. Code may well become consciousness.

And right there, in the steepest part of the curve where all exponential technologies now live—Bank of America pins Bitcoin to the wall.

Why?

Because Bitcoin doesn’t just represent digital money.

It represents a new system that paves the way for a dramatically different future.

It’s the printing press for central banking.

It’s the internet for property rights.

It’s the seatbelt for runaway monetary policy.

What This Really Means

This isn’t about investment theses or 5-year charts.

This is about recognition.

It’s about a TradFi institution quietly admitting that Bitcoin isn’t a phase—it’s a foundational protocol. A re-architecting of money, sovereignty, and incentive structures.

In other words: it’s too important to ignore.

If you’re a nation, Bitcoin is your strategic escape hatch.

If you’re a company, it’s your balance sheet’s firewall.

If you’re an individual, it’s your last line of defense—and your first tool for self-sovereignty in a digitized world.

The Power of Inclusion

There are only 21 innovations on the list.

There will only ever be 21 million bitcoin.

Poetic? Maybe.

Intentional? Probably not.

But significant? Hell yes.

Because these 21 technologies didn’t just disrupt—they redefined the world:

The printing press democratized knowledge.

The steam engine ignited the industrial age.

The internet rewired communication.

Now, Bitcoin redefines consensus, property, and time.

The Smartest Institutions Are Paying Attention

Bank of America didn’t need to include Bitcoin.

But they did.

That tells you everything you need to know.

The narrative is flipping.

The legacy system is studying what it once dismissed.

The future is no longer about whether Bitcoin will succeed—it’s about who understood it in time.

Bitcoin is not a get-rich-quick scheme. It’s a don’t-get-wiped-out protocol.

Stack wisely.

Build sovereignly.

We’re living in one of the 21 moments that changed the world.

Well, that's a wrap for today y’all. If you found this helpful or it got you thinking, why not hit that 'like' button and share it with your buddies? The more we share, the more we all learn.

Disclaimer: The goal here is to educate and entertain. However, keep in mind, this isn't financial advice. I'm a regular person like you, sharing my perspectives based on my personal research and experiences. Always do your own research (DYOR) and make your own informed decisions.

Your thoughts and feedback on the content are always welcome. Feel like chatting about something? Reach out here or on Social Media, and let's start a conversation.

If you're viewing this in podcast notes, some embedded links might not be accessible. For the full experience and all the juicy links, head over to my Substack (lumberhawknews.substack.com).

Cheers!

If you would like to donate to support the Value for Value Bitcoin economy, below is my lightning wallet.